louis vuitton tax free | Louis Vuitton tax free japan louis vuitton tax free What you need to know if shopping tax-free at Louis Vuitton and Chanel Non-EU citizens, which includes British travellers as a result of Brexit, can now reclaim the tax on purchases made on a majority of items such as clothing, jewelry, electronics, beauty products, and much more. Scotland. Speyside. Aberlour A'bunadh batch #77. Whiskybase ID. WB231089. Category. Single Malt. Distillery. Aberlour. Bottler. Distillery Bottling. Bottled. 22.03.2023. Cask Type. Spanish Oloroso Sherry Butts. Casknumber. Batch 077. Strength. 60.8 % Vol. Size. 700 ml. Barcode. 5010739261523. Added on. 24 apr 2023 9:04 pm by .Aberlour A’Bunadh single malt scotch is a lovely, rich, and complex sherry-cask-aged Speyside area single malt with a spice-driven .

0 · tax free Louis Vuitton lisboa

1 · gucci vat refund italy

2 · Louis Vuitton tax refund uk

3 · Louis Vuitton tax refund

4 · Louis Vuitton tax free japan

5 · Louis Vuitton shopping tax refund

6 · Louis Vuitton online return

7 · Louis Vuitton france vat refund

Historical is used as the general term for describing history, such as 'the historical record,' while historic is now usually reserved for important and famous moments in history, such .

tax free Louis Vuitton lisboa

lv trunk case iphone 11 pro max

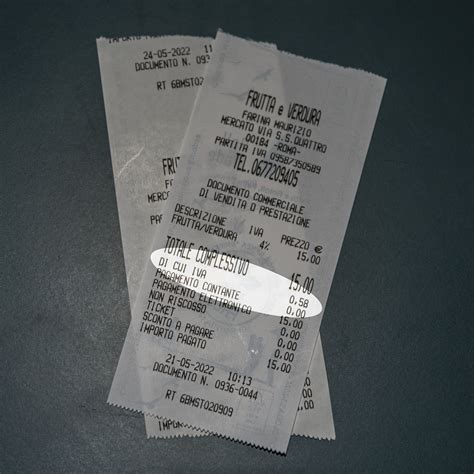

In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to .What you need to know if shopping tax-free at Louis Vuitton and Chanel Non-EU citizens, which includes British travellers as a result of Brexit, can now reclaim the tax on purchases made on . Participating shops post a sign indicating their tax-free status in their windows in English. Eligible Purchases: Clothing, handbags, shoes and accessories totaling 5000JPY (about 50USD) or more on a single receipt. In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury .

What you need to know if shopping tax-free at Louis Vuitton and Chanel Non-EU citizens, which includes British travellers as a result of Brexit, can now reclaim the tax on purchases made on a majority of items such as clothing, jewelry, electronics, beauty products, and much more.

Louis Vuitton Services. All orders are carefully packaged in the Maison's iconic boxes. LOUIS VUITTON Official USA site - Explore the World of Louis Vuitton, read our latest News, discover our Women's and Men's Collections and locate our Stores.European prices include VAT (value added tax) - if you live outside the EU you can claim it back on some purchases. Things are not “tax free” but it’s not an additional charge on like it is in the US because it’s already factored into the price.For international purchases with tax-free claims, the item can be exchanged for an item of same retail price or refunded for store credit for full amount without tax. When exchanging for an item, the difference between tax-free price and UK retail price must be paid to Louis Vuitton. When clearing Customs, an officer has the authority to impose a tax on all your purchases. It could be as low as 3% or rise to 12% or more. In calculating the duty owed, there is an 0 exemption per person that is applied first. This means that the first 0 spent abroad is .

One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers.

Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Travel with family. The United States allows 0 per person of duty-free goods. If you travel with a family of four, that’s ,200 collectively of U.S. tax–free import.LOUIS VUITTON Official USA site - Find the address and opening hours of a store near you, discover our latest Women's and Men's Collections. Participating shops post a sign indicating their tax-free status in their windows in English. Eligible Purchases: Clothing, handbags, shoes and accessories totaling 5000JPY (about 50USD) or more on a single receipt.

gucci vat refund italy

In many countries, duty-free shops operate in tax-free zones, which means you can purchase Louis Vuitton products without having to pay any sales tax. This can result in substantial savings, especially when it comes to luxury .What you need to know if shopping tax-free at Louis Vuitton and Chanel Non-EU citizens, which includes British travellers as a result of Brexit, can now reclaim the tax on purchases made on a majority of items such as clothing, jewelry, electronics, beauty products, and much more.Louis Vuitton Services. All orders are carefully packaged in the Maison's iconic boxes. LOUIS VUITTON Official USA site - Explore the World of Louis Vuitton, read our latest News, discover our Women's and Men's Collections and locate our Stores.European prices include VAT (value added tax) - if you live outside the EU you can claim it back on some purchases. Things are not “tax free” but it’s not an additional charge on like it is in the US because it’s already factored into the price.

For international purchases with tax-free claims, the item can be exchanged for an item of same retail price or refunded for store credit for full amount without tax. When exchanging for an item, the difference between tax-free price and UK retail price must be paid to Louis Vuitton.

When clearing Customs, an officer has the authority to impose a tax on all your purchases. It could be as low as 3% or rise to 12% or more. In calculating the duty owed, there is an 0 exemption per person that is applied first. This means that the first 0 spent abroad is . One of the easiest ways to avoid paying taxes on your Louis Vuitton purchases is by buying them from duty-free shops. These shops are typically located in airports or on international waters, and they offer tax-free shopping to travelers.

Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Travel with family. The United States allows 0 per person of duty-free goods. If you travel with a family of four, that’s ,200 collectively of U.S. tax–free import.

WB46209. Category. Single Malt. Distillery. Aberlour. Bottler. Distillery Bottling. Bottling serie. Double Cask Matured. Stated Age. 16 years old. Cask Type. Oak and Sherry Oak Casks. Strength. 40.0 % Vol. Size. 700 ml. Label 2010-2019. Bottle code. LKPJ 2753. Barcode. 5000299298022. Added on. 14 nov 2013 2:51 pm. Photo by Ailios. Overall rating.

louis vuitton tax free|Louis Vuitton tax free japan